Your 2023 Taxes

Tax Brackets in 2023

We’re only 3/4 through 2023 – surely too early to start thinking about taxes, right?

Think again.

Already this year, we’ve seen massive market volatility. Maybe you’re considering capturing gains from the current run-up or trimming some losing positions to plan a tax harvesting strategy proactively. Either way, now is the perfect time to brush off your annual tax plan and start proactively thinking about its impact on your 2024 financial goals.

We’ll look at the Internal Revenue Service’s (IRS) tax provisions for 2023 to help you get a leg up on your efforts but remember – it's critical to vet any information and your overall plan through your tax professional. Tax teams are a vital part of your financial planning ecosystem, so touch base before setting anything in stone.

How Does the IRS Deal with Inflation?

One of the IRS’ critical roles is determining how to account for inflation. Inflation can cause bracket creep, which pushes payers into a higher bracket due to nominal increases in income. In this case, citizens are on the hook for greater tax payments without seeing much additional cash in their pocket or increased spending power due to inflation.

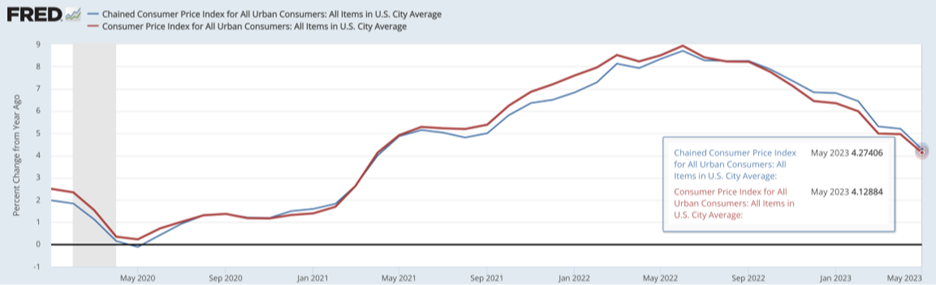

You’re likely familiar with the Consumer Price Index (CPI), the standard way to measure inflation. Instead of the CPI, though, the IRS measures inflation with the Chained Consumer Price Index (C-CPI).

What is the Chained Consumer Price Index?

The C-CPI differs slightly from the CPI, typically resulting in a lower inflation estimate. Aside from differences in the actual calculation, the C-CPI tries to negate two pitfalls to the standard CPI: the substitution bias and small-sample bias.

The substitution bias happens when consumers pick lower-cost alternatives to goods and can skew results if the index measures an increasingly pricier product that consumers are swapping for an alternative. In short, the substitution bias in the CPI doesn’t always account for rational consumer behavior at the grocery store or retail outlet.

Likewise, the small-sample bias in the index happens when, by virtue of practicality, measurement and polling techniques are constrained by a relatively small number of aggregate prices. The small sample may not represent the whole, further expanding inflation reports.

To combat the substitution bias, the C-CPI aggregates pricing from two consecutive months (chaining them together) to determine a better average as consumers adjust their spending habits. The C-CPI uses a geometric average rather than the standard CPI’s arithmetic average to account for the small-bias effect.

Source: Federal Reserve Economic Data

Here, we see the difference in action: although by a slim margin, the C-CPI measures inflation lower than the standard CPI at 4.1% in May 2023 compared to the CPI’s 4.3%.

2023’s Adjusted Tax Brackets

Note: all data comes from the Internal Revenue Service’s 2023 tax inflation adjustments report.

The standard deduction, like the brackets themselves, is adjusted to account for inflation. Remember that the standard deduction is how much non-itemizing taxpayers can deduct from their income before taxation kicks in. If you aren’t itemizing, a higher standard deduction is usually preferred.

| Taxpayer | 2023 Standard Deduction | 2022 Standard Deduction | $ Difference | % Difference |

|---|---|---|---|---|

| Couples filing jointly | $27,700 | $25,900 | $1,800 | +6.9% |

| Single/couples filing separately | $13,850 | $12,950 | $900 | +6.9% |

| Head of Household | $20,800 | $19,400 | $1,400 | +7.2% |

Ultimately, these are 2023’s tax brackets to consider when planning the rest of your year’s tax strategy:

| Rate | Single/Couples Filing Separately | Married Filing Jointly | Heads of Households |

|---|---|---|---|

| 10% | $0 to $11,000 | $0 to $22,000 | $0 to $15,700 |

| 12% | $11,000 to $44,725 | $22,000 to $89,450 | $15,700 to $59,850 |

| 22% | $44,725 to $95,375 | $89,450 to $190,750 | $59,850 to $95,350 |

| 24% | $95,375 to $182,100 | $190,750 to $364,200 | $95,350 to $182,100 |

| 32% | $182,100 to $231,250 | $364,200 to $462,500 | $182,100 to $231,250 |

| 35% | $231,250 to $578,125 | $462,500 to $693,750 | $231,250 to $578,100 |

| 37% | $578,125+ | $693,750+ | $578,100+ |

Other 2023 Tax Adjustments

- While the standard deduction and tax brackets apply to nearly all payers, some subtle changes in the IRS’ tax planning affect individual citizens and couples to varied degrees. These are a few of the most common and wide-ranging changes in 2023:

- The Earned Income Tax Credit, benefiting low-income working families, is $560 for childless filers, $3,995 for a single child, $6,604 for two, and $7,430 for three or more children. In 2022, the maximum credit for three or more children was $6,935.

- The Child Tax Credit remains fixed, unaffected by inflation, and is set at $2,000. However, the refundable portion of the credit jumped $100 to $1,600 for 2023.

→ Capital gains tax rates are typically at most 15% for many taxpayers.

→ Capital gains may be taxed at 0% for individuals and couples filing separately if income doesn’t exceed $41,675, $83,350 for married filing jointly, and $55,800 for heads of household.

→ A 15% capital gains tax may apply for single filers with income more than $41,675 but less than $459,750, more than $83,350 but less than $517,200 for joint filers, and more than $55,800 and less than $488,500 for heads of household. Married filing jointly sees a 15% capital gains tax if income exceeds $41,675 but is less than $258,600.

→ If income in any category exceeds the upper limit for 15%, a 20% capital gains tax rate may apply.

→ You can continue to claim up to $3,000 in capital losses to lower your income and carry the balance to future years if you exceed that.

Retirement Account Contributions in 2023

Some retirement accounts contribution limits also increased for 2023. This year, you can contribute:

- Up to $22,500 for 401(k), 403(b), most 457, and TSP plans.

- Up to $6,500 for IRAs.

Gearing Up for Tax Season

Again, consulting with your tax team before determining a plan of action for 2023 taxes is critical. Still, it’s best to prepare early, as due diligence today may drive your investment and savings plans for the remainder of 2023. Remember – the best plan is developed early, so connect with your tax planner today to ensure a fruitful rest of 2023 and an easy entry into 2024.